what is a provisional tax code

Department of the Treasury. Provisional tax helps you manage your income tax.

What Is A Provisional Taxpayer Tax 101 Youtube

Provisional tax can be explained as an advance payment made to offset against the Income Tax Liability for the respective year of assessment.

. Tax on 80 of actual taxable income R1 280 000 R412 611. Provisional tax is not a separate tax. INC Payments for income tax and provisional tax.

Youll pay tax on whichever amount is smaller. 1 The base from 86 of the Internal Revenue Code IRC triggers the taxability of social security. Provisional taxpayers calculate their provisional tax.

It requires the taxpayers to pay at least two amounts in advance during the year of assessment which are based on estimated taxable income. Provisional tax allows the tax liability to be spread over the relevant year of assessment. IED For intermediaries payroll providers paying employee deductions.

Provisional taxpayers are people who earn income other than a salary remuneration on which no income tax has been deductedwithheld. You pay it in instalments during the year instead of a lump sum at the end of the year. 0 if youre married filing a separate return and lived with your spouse at any time during the tax year.

An example of this are individuals who earn income from other sources during any year of assessment. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of assessment. Youll have to pay provisional tax if you had to pay more than 5000 tax at the end of the year from your last return.

A third payment is optional after the end of the tax year but before the issuing of the assessment by SARS. In certain contexts the term tax code is used to refer to a codethat is a series of numbers and lettersthat has some significance for indirect tax payroll tax or other tax purposes. 2500 before the 2020 return.

The assessment and the payment of the 1 st installment can be created via Tax Portal. It is paid by two equal installments on the 31st of July and 31st of December of each year in two equal installments for the given year. After clicking through the exit link below select the applicable year select 26.

It requires the taxpayers to pay at least two amounts in advance during the year of assessment which is based on estimated taxable income. Its payable the following year after your tax return. If you are a provisional taxpayer it is important that you make adequate provisional.

Provisional income is an IRS threshold above which social security income is taxable. GST payments for Goods and services tax GST return - GST101A filers. 2 If your provisional income exceeds these thresholds youll compare 50 of your benefits amount to 50 of your provisional income that exceeds the threshold.

Provisional income is an amount used to determine if social security benefits are taxable. These sources include rental income generated interest income received or any other income from the carrying on of a trade. This obligation to pay provisional tax can arise in addition to the taxpayers employer deducting tax.

Provisional tax is a way of paying your income tax in instalments during the year. Provisional tax is the IRDs tool to prevent these sorts of tax bills. Provisional income is an amount used to determine if social security benefits are taxable.

2500 before the 2020 return. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not have a large tax debt on assessment. GAP GST and provisional tax payments for Goods and services tax GST and provisional tax return - GST103 filers.

Income Tax Treatment of Social Security Benefits The income tax treatment of social security benefits is governed by section 86 of the Internal Revenue Code the Code. A tax code is a unified set of laws that provide the statutory basis for all tax systems within a nation or other jurisdiction. Prior to 1983 social security benefits were not subject to income tax.

A provisional taxpayer is required to pay instalments of income tax called provisional tax during the income year rather than at the end of the year when a tax return is filed. A person who receives or to whom accrues other than a salary is a provisional taxpayer. The purpose of the payments is to help you the taxpayer avoid getting too far behind on your taxes.

The base from 86 of the Internal Revenue Code IRC triggers the taxability of social security benefits. Treasury regulations 26 CFR--commonly referred to as Federal tax regulations-- pick up where the Internal Revenue Code IRC leaves off by providing the official interpretation of the IRC by the US. Provisional tax is a system that ensures those who earn income from sources other than an employer pay tax during the tax year.

Heres a list of the codes to use for different tax or account types. Treasury regulations 26 CFR--commonly referred to as Federal tax regulations-- pick up where the Internal Revenue Code IRC. Treasury regulations 26 CFR--commonly referred to as Federal tax regulations-- pick up where the Internal Revenue Code IRC leaves off by providing the official interpretation of the IRC by the US.

The provisional tax is actually the payment in advance of this years income tax. Provisional tax helps you manage your income tax. This assists taxpayers in lessening their tax bill at the end of the tax period by allowing advance payments in two smaller payments 3rd payment is optional based on estimates.

Its payable the following year after your tax return. Its income tax paid in instalments throughout the current tax year in order to help taxpayers avoid those big tax bills. Treasury Tax Regulations.

Provisional income calculations can get a bit complex though it is all laid out in 86 of the Internal Revenue Code IRC. It requires the taxpayers to pay at least two amounts in advance during the year. Provisional taxpayers are required to pay income tax on their earnings six months after the start of the tax year at the end of August and again by the end of the tax year at the end of February.

They will need to declare their total estimate taxable income on their provisional tax. Provisional tax is not a separate tax. According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the previous tax year and calculated for 12 months and requires prepayment for the next tax.

Image Result For Gst Format Delivery Challan Invoicing Banking Institution Goods And Services

What Is A Provisional Taxpayer Tax 101 Youtube

Intellectual Property Firms How To Protect Intellectual Property Provisional Patent Application Intellectual Pro Invention Patent Inventions Financial Literacy

Stargaze Pattern By Amanda Leah Guthrie Stargazing Extra Yarn Pattern

What Is A Provisional Taxpayer Tax 101 Youtube

How To Get The Italian Tax Code Codice Fiscale Yesmilano

Pearson Edexcel Level 3 Gce Statistics Advanced Paper 2 Statistical Inferenc The Predictror In 2022 Pearson Edexcel Question Paper Physical Chemistry

Italian Tax Code Codice Fiscale Studio Legale Metta

Skillselect Invitation Round Held On May 2019 For Subclass 189 And 489 Australia Immigration Hold On Invitations

Understanding Basics Of Bankruptcy Types Of Property And Debts Bankruptcy Filing Bankruptcy Attorneys

Bmc Prepares To Go Cashless Oppn Sceptical About Success Developing Country Property Tax Success

Best Startup Solutions Company Registration In India Complypartner Start Up Startup Company Digital Marketing Services

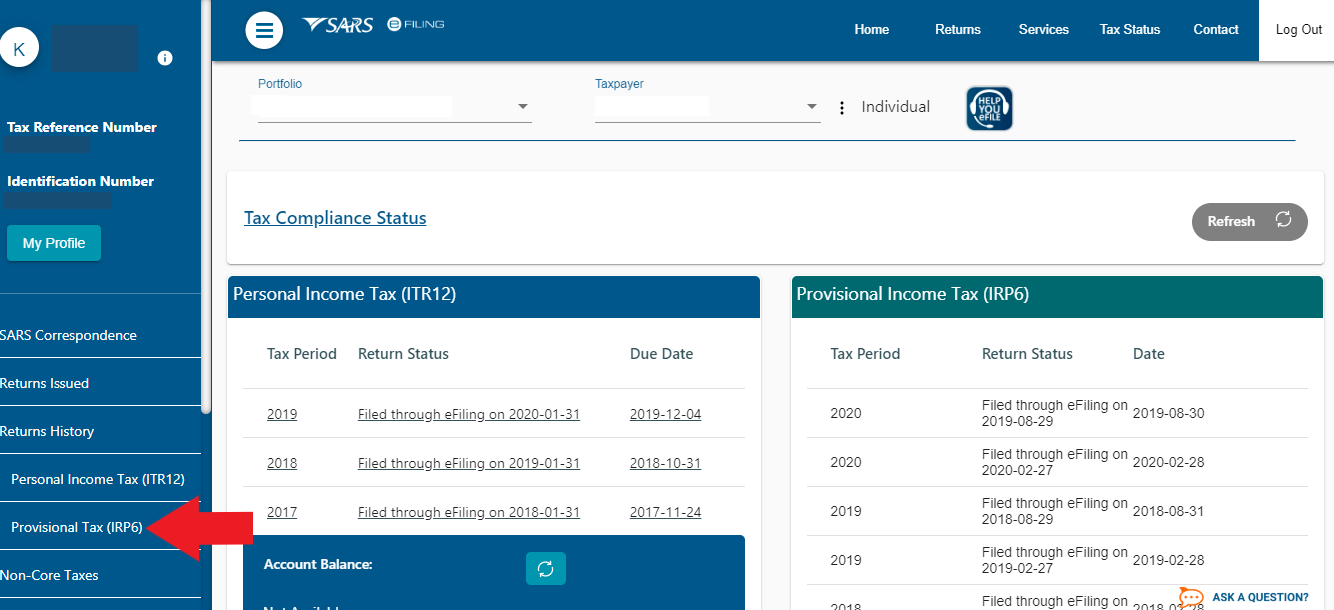

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Wildfire Blaze Pattern By Amanda Leah Guthrie Sport Weight Yarn Knit Patterns Pattern

Pin By Swapna On Imp Lowercase Alphabet Lowercase A Lettering

Aspen Roots Pattern By Amanda Leah Guthrie Pattern Knitting Cozy Shawl

Where S My Amended Return 7 Points One Must Know Https Www Irstaxapp Com Wheres My Amended Return Income Tax Return How To Find Out Business Tax